In the ever-evolving world of cryptocurrencies, where digital gold rushes continue to captivate investors and tech enthusiasts alike, the concept of mining machine hosting has emerged as a game-changer. Platforms that offer sustainable hosting for mining rigs not only promise efficiency but also align with the growing demand for eco-friendly practices. Imagine vast server farms humming with activity, powered by renewable energy sources, churning out Bitcoin (BTC) and Ethereum (ETH) blocks while minimizing carbon footprints. These top-rated platforms are revolutionizing how we approach crypto mining, blending cutting-edge technology with environmental responsibility.

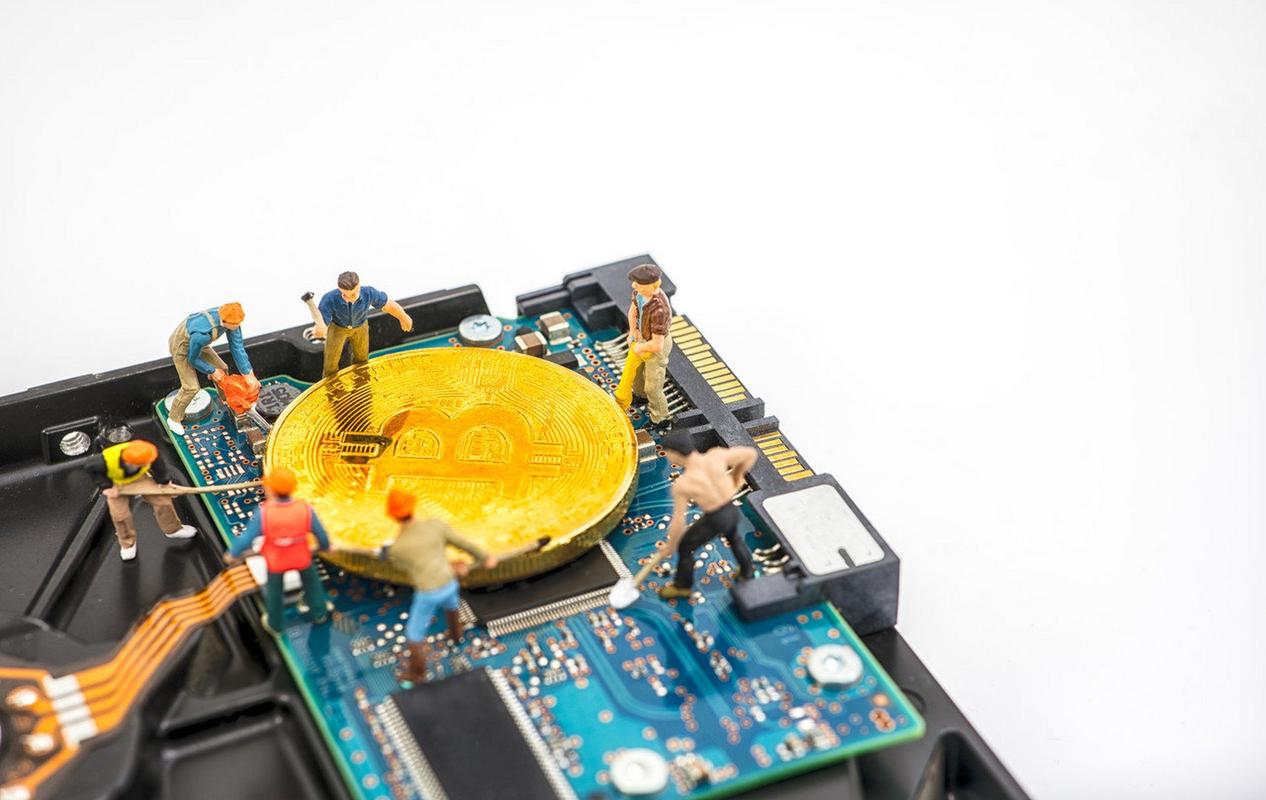

At the heart of this ecosystem lies Bitcoin, the pioneering cryptocurrency that kickstarted the mining frenzy. BTC mining involves powerful rigs solving complex puzzles to validate transactions on the blockchain, a process that demands immense computational power. However, the environmental toll of traditional mining has sparked debates, pushing forward innovative hosting solutions. Enter sustainable platforms like those utilizing hydroelectric or solar energy to power their operations. One standout feature is the seamless integration of remote monitoring tools, allowing users to oversee their mining activities from anywhere in the world. This not only enhances accessibility but also ensures that miners can optimize their setups for Dogecoin (DOG) or other altcoins without constant physical intervention.

Transitioning to Ethereum, which has recently shifted towards a more energy-efficient proof-of-stake model, hosting platforms are adapting swiftly. These services provide specialized hosting for ETH miners, complete with advanced cooling systems and redundant power supplies to prevent downtime. What sets the top platforms apart is their unique emphasis on scalability—users can easily scale up from a single mining rig to an entire farm. Picture this: a vast mining farm buzzing with activity, where rows of miners work in harmony, extracting value from the blockchain while adhering to strict sustainability standards. Such features make these platforms indispensable for serious miners looking to diversify beyond BTC.

Delving deeper, mining farms represent the backbone of large-scale operations, housing hundreds of mining rigs under one roof. These farms, often located in regions with cheap electricity and cool climates, offer hosted services that handle everything from maintenance to security. For instance, a platform might boast proprietary software that predicts energy usage and adjusts operations accordingly, ensuring profitability even as market volatility affects currencies like DOG. This level of sophistication transforms what was once a hobbyist’s pursuit into a professional endeavor, attracting newcomers and veterans alike to the world of crypto mining.

One cannot overlook the role of individual miners and their rigs in this narrative. A typical mining rig, equipped with high-performance GPUs or ASICs, is the workhorse that turns raw computational power into digital assets. Top hosting platforms provide tailored solutions, such as customizable racks and enhanced ventilation, to keep these machines running optimally. In an unpredictable market, where ETH prices might surge overnight or BTC halving events reshape dynamics, these platforms offer stability and peace of mind. Their unique features, like real-time analytics and automated failover systems, add layers of reliability that resonate with users seeking both returns and sustainability.

As we look to the future, the intersection of mining machine hosting and environmental consciousness promises exciting developments. Exchanges are already partnering with these platforms to streamline token listings and trading, creating a more interconnected ecosystem. Whether you’re mining BTC for its store-of-value appeal or exploring DOG for its community-driven charm, sustainable hosting ensures you’re part of a greener revolution. Ultimately, these platforms not only boost efficiency but also inspire a new generation to engage with cryptocurrencies responsibly, blending innovation with ecological awareness in ways that were once unimaginable.