The cryptocurrency market has taken the world by storm, revolutionizing the way we perceive value and conduct transactions. As we approach 2025, it is crucial to equip ourselves with knowledge about high-performance mining equipment tailored for this dynamic landscape. Whether you’re venturing into Bitcoin (BTC), Dogecoin (DOG), or Ethereum (ETH), having the right mining machines can significantly enhance your success.

In essence, cryptocurrency mining involves validating transactions and adding them to the blockchain. This process requires robust hardware that can withstand the rigorous demands of computational power, energy efficiency, and durability. High-performance miners, specifically designed to compute hashes at incredible speeds, are pivotal in ensuring profitability. Technologies will only accelerate in sophistication, making it vital for prospective miners to stay ahead with the latest equipment.

The year 2025 is poised to introduce cutting-edge mining rigs that leverage advancements in chip technology, such as ASICs (Application-Specific Integrated Circuits). These specialized processors will vastly outperform conventional mining rigs in both power and efficiency. ASIC miners, once deemed extreme investments, are now becoming mainstream as their performance metrics skyrocket, making them a staple for any serious miner.

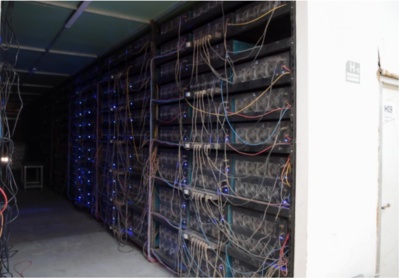

Hosting mining machines is becoming an increasingly attractive option for those who want to dive into the cryptocurrency realm without the complexities of managing hardware. Hosting services provide miners with dedicated space, cooling solutions, and professional management, allowing them to focus solely on maximizing mining rewards. By opting for hosting, you also gain access to state-of-the-art facilities that boast uninterrupted power supply and high-speed internet, making it an unbeatable choice.

But what about the various cryptocurrencies that can be mined? While Bitcoin may reign supreme, several altcoins like Ethereum, and even Dogecoin can also be highly lucrative under specific conditions. Each currency offers unique algorithms and hashing methods, necessitating tailored approach to mining equipment. For instance, Ethereum operates on a proof-of-stake model in its transition to ETH 2.0, which may alter the use case for traditional mining rigs. Understanding the specific requirements of each coin ensures optimal performance and reward.

Moreover, the mining farm has emerged as a fundamental concept in the cryptocurrency space. These facilities house numerous mining rigs, often utilizing renewable energy sources to maintain sustainability and reduce operational costs. As environmental concerns become increasingly prominent, miners need to consider efficient energy consumption and carbon footprint. In 2025, we anticipate more mining farms will adopt sustainable practices, integrating solar panels and green technologies.

Joining the cryptocurrency mining landscape isn’t solely about acquiring high-performance equipment. An understanding of exchanges and trading strategies is crucial. As cryptocurrencies fluctuate wildly, establishing a solid trading plan can directly influence your returns. Selecting a reliable exchange platform with robust security measures ensures your investments are safe, allowing you to trade or convert mined crypto efficiently.

Another pivotal area taking shape by 2025 is the software that accompanies mining hardware. Advanced algorithms and user-friendly interfaces will redefine how miners control their operations. This software will provide insights into performance metrics, enabling miners to adjust their strategies in real-time. Furthermore, machine learning algorithms will aid in predicting optimal mining times, powering decentralized decision-making that enhances profitability.

As we delve deeper into the world of cryptocurrencies, we must focus on security as a core pillar of any mining operation. With the rise of cyber threats, securing hardware and digital assets becomes an immediate concern. It is not uncommon for large-scale operations to invest in cutting-edge security infrastructure, including physical security and advanced firewall systems to safeguard mining rigs from potential breaches.

In conclusion, as we gear up for 2025, embracing the relentless evolution of mining equipment, strategies, and technologies smartly will lay the foundation for success in the cryptocurrency market. The confluence of performance, sustainability, and security will redefine the mining experience, ensuring that both new and seasoned miners can flourish in this exhilarating environment. Investing in high-performance mining equipment is not merely a choice—it is an imperative for those who want to thrive in this ever-evolving digital economy.