In the sprawling landscape of cryptocurrency mining, the United States has emerged as a pivotal hub for advanced mining operations and cutting-edge technology. At the heart of this revolution lie ASIC miners—specialized hardware designed for the singular purpose of maximizing efficiency in mining cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), and more. Understanding the best ASIC miners available in the USA not only empowers investors and enthusiasts but also sheds light on how the crypto ecosystem continues to evolve with technological innovation and strategic hosting solutions.

ASIC, or Application-Specific Integrated Circuit, miners are revolutionary because they are meticulously engineered to perform the mining process with unparalleled speed and energy efficiency. Unlike GPU or CPU miners who take a more general approach, ASIC miners channel every transistor and circuit towards cracking the cryptographic puzzles essential for validating blockchain transactions. This focused power magnetizes those looking to optimize returns in a volatile and highly competitive mining space, especially when mining BTC or DOGE where processing speed directly correlates with profitability.

When considering the top ASIC miners in the USA, names like Bitmain’s Antminer series, MicroBT’s Whatsminer, and Canaan’s Avalon miners frequently surface in discussions. The Antminer S19 Pro model, for instance, is renowned for its stellar hash rate that pushes upwards of 110 TH/s while maintaining a power efficiency ratio that’s economically viable for operators running large-scale mining farms. These specifications translate into thousands of validated Bitcoin transactions daily, cementing its reputation as an industrial-grade heavy hitter in the market.

The pursuit of excellence in ASIC mining is not merely about acquiring cutting-edge hardware—it also demands optimal hosting environments. Mining machine hosting has surged in popularity among American miners who seek to outsource energy-intensive operations to facilities equipped with sustainable energy sources and robust infrastructure. Hosting providers offer more than just space; they bring power redundancy, enhanced cooling systems, and enterprise-grade network connectivity that dramatically minimize downtime, ensuring miners extract maximum hash power without the logistical headaches.

Parallel to hosting, cryptocurrency exchanges play a critical role in this expanding ecosystem. Miners, after extracting coins like BTC, ETH, or DOGE, rely on exchanges to liquidate these assets or swap them for portfolio diversification. The symbiotic relationship between ASIC miners, hosting services, and exchanges forms a streamlined pipeline where mined tokens seamlessly transition into tradable assets—fueling liquidity across global markets and driving the cyclical momentum of crypto trading.

It’s worth noting that Ethereum, while still embracing GPU mining due to its algorithm changes, is steadily transitioning towards Proof of Stake, leaving the ASIC mining focus primarily to Bitcoin and Dogecoin enthusiasts. Dogecoin mining, in particular, is gaining traction within niche communities that leverage combined mining rigs capable of hashing multiple coins or engaging in merge mining strategies. This tactic maximizes resource utilization and increases profitability—a testament to how mining rigs continue adapting through innovation and user needs.

The recent surge in demand for ASIC miners has also sparked fierce competition among manufacturers, leading to a surge in varied models specifically tailored for different cryptocurrencies and hash functions. From the high-powered SHA-256 algorithm miners perfect for Bitcoin and Dogecoin to newer hash functions, ASIC devices today exhibit remarkable diversity in their capabilities and application scenarios. This diversification is pivotal; it allows miners across the USA to build customized portfolios of machines, balancing upfront costs, energy consumption, and coin profitability.

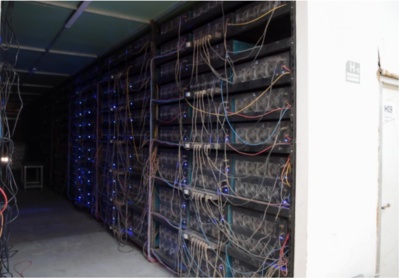

Moreover, mining farms—the colossal venues housing thousands of ASIC miners—have become emblematic of the industrialization of crypto mining. These farms leverage economies of scale, often secured by cheap or renewable energy sources, to drive down operational costs per terahash. Within these technology ecosystems, miners operate not as isolated devices but as a synchronized fleet, engaging in continuous optimization via firmware updates, cooling innovations, and network enhancements.

For businesses and hobbyists eyeing entry into this domain, it’s crucial to consider the full spectrum of factors influencing ASIC mining success. These include hardware specifications, energy pricing, hosting facility reputation, anticipated coin market demand, and even regulatory landscapes that can impact energy usage or cryptocurrency legality. The intricate dance between these elements shapes the overall experience and profitability of mining operations in today’s dynamic American market.

In conclusion, unveiling the best ASIC miners in the USA is more than a mere hardware assessment—it’s an exploration into the vibrant interconnected world of cryptocurrency mining, hosting services, exchange dynamics, and the relentless enthusiasm fueling blockchain innovations. As the market matures, miners with the foresight to leverage efficient hardware, deploy robust hosting solutions, and remain agile to evolving currency trends will inevitably lead the charge into the next frontier of digital asset generation.